unemployment tax refund 2021 update

IR-2021-212 November 1 2021. Irs unemployment tax refund update.

Irs Sending Out Unemployment Tax Refunds For Those Who Overpaid Youtube

The IRS will determine the correct taxable amount of unemployment compensation and tax.

. Efile your tax return directly to the IRS. Irs unemployment tax refund august update. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. IRS will send these payments in phases. Unfortunately an expected income tax refund is property of the bankruptcy estate.

100 Free Tax Filing. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year.

Many filers are able to protect all or a portion of their income tax refunds by applying their bankruptcy exemptions to the expected refund. Already filed a tax return and did not claim the unemployment exclusion. See the 2020 Unemployment Compensation Exclusion FAQs for more information including details on filing an amended return.

IR-2021-159 July 28 2021. On May 14 the Internal Revenue Service announced they will be correcting and sending out the unemp. Did not claim the following credits on their tax return but are now eligible when the unemployment exclusion is applied.

But the unemployment tax refund can be seized by the IRS to pay debts that are past due. Phase 1 is for tax. Timeline For Unemployment Tax Refunds.

The most recent batch of unemployment refunds went out in late july 2021. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. Military Request for Relief from Lien Sales ECB and Parking Judgments and Tax Warrants.

100 free federal filing for everyone. The unemployment tax refund is only for those filing individually. Non-resident Employees of the City of New York - Form 1127.

Generally after using all of your available exemptions the remaining unprotected amount is often little or nothing. The unemployment tax refund is from the 10200 exclusion from the American Rescue Plan. Prepare federal and state income taxes online.

Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are. In the latest batch of refunds announced in November however the average was 1189. This video is about the 2021 IRS unemployment tax refund.

NYC-200V Payment Voucher for Tax Returns and Extensions. See How Long It Could Take Your 2021 State Tax Refund. 2021 tax preparation software.

Power of Attorney POA-2. This video is about the 2021 IRS unemployment tax refund. Recovery Rebate Credit.

The American Rescue Plan Act had waived federal tax on up to 10200 of benefits collected in 2020. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the American Rescue Plan Act of 2021 ARPA which allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The federal tax code counts jobless benefits as taxable income. Ad File your unemployment tax return free. On May 14 the Internal Revenue Service announced they will be correcting and sending out the unemployment tax refund.

See reviews photos directions phone numbers and more for New Jersey Tax Refund locations in Piscataway NJ. With the latest batch of payments in July the IRS has now issued more than 87 million unemployment compensation refunds totaling over 10 billion. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Dont expect a refund for unemployment benefits. Premium federal filing is 100 free with no upgrades for unemployment taxes. An estimated 13 million taxpayers are due unemployment compensation tax refunds.

To check the status of your 2021 income tax refund using the IRS tracker tools. In july of 2021 the irs announced that another 15 million taxpayers will receive refunds averaging more than 1600 as the irs is still processing tax returns. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

Check For The Latest Updates And Resources Throughout The Tax Season. Those taxpayers in this latest.

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Covid 19 And Your Taxes Our Experts Answer All Your Questions

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Average Tax Refund Up 11 In 2021

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

Tax Season 2021 Is Open And Comes With A Lot Of Issues The Washington Post

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds

I Finished Filing My Taxes What Now 2022 Turbotax Canada Tips

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

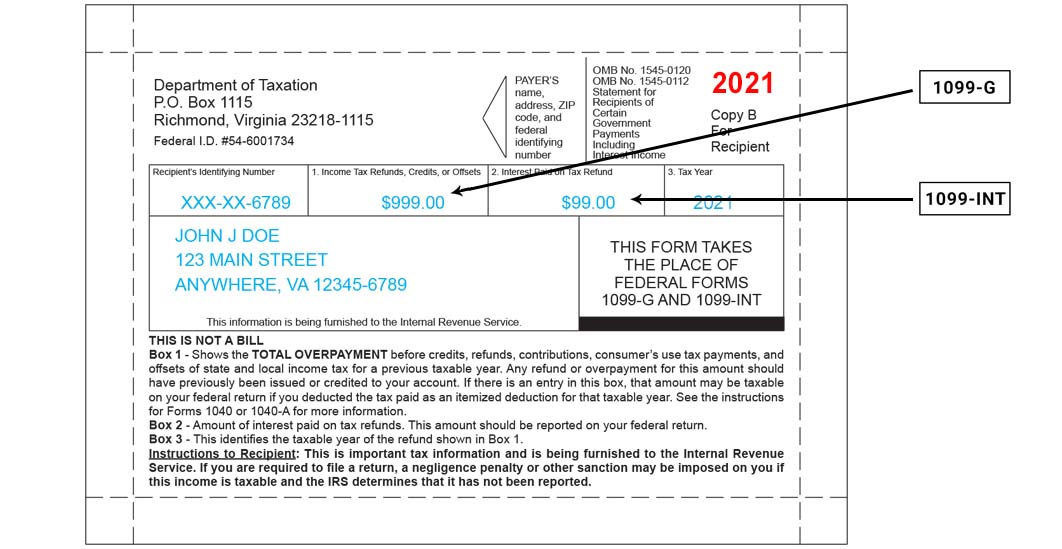

1099 G 1099 Ints Now Available Virginia Tax

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return